The notice application forms and certificate application forms have been updated for use upon any future application made under the Shipping Reform (Tax Incentives) Act 2012.

The new application forms are available at Applying for tax incentives.

There are a range of tax incentives that may be available in respect of operations associated with the Australian shipping industry. The tax incentives are designed to encourage investment in the Australian shipping industry and to encourage the development of sustainable employment and skills opportunities for Australian seafarers. They are:

- shipping exempt income tax incentive for Australian operators of Australian registered eligible vessels on qualifying shipping income

- accelerated depreciation and rollover relief for Australian corporate owners of Australian registered eligible vessels

- seafarer tax offset for Australian corporate employers who employ eligible Australian seafarers on overseas voyages performed by Australian registered eligible vessels

- exemption from royalty withholding tax for foreign owners of eligible vessels leased under a bareboat or demise charter to an Australian resident company.

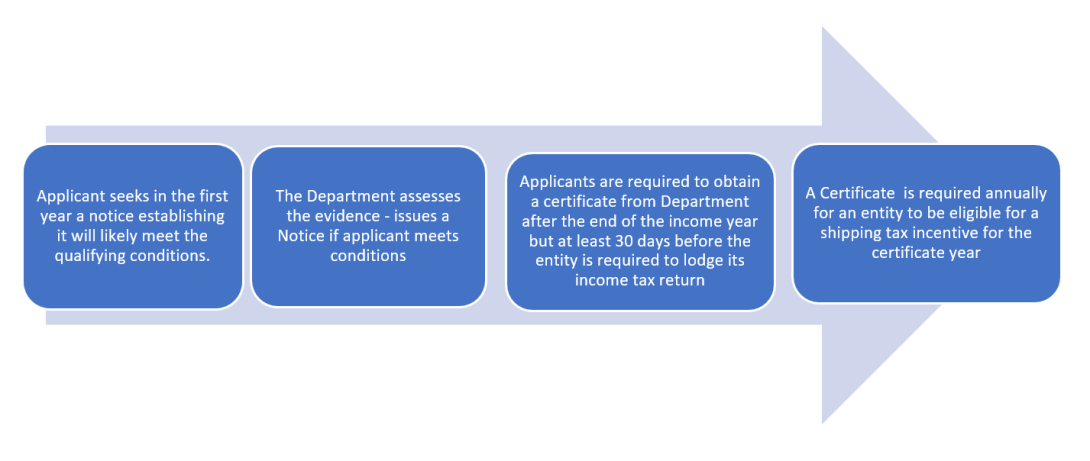

Eligibility for the first three tax incentives is dependent on a certificate being issued for the eligible vessel under the Shipping Reform (Tax Incentives) Act 2012 (the Act). For a shipping exempt income certificate to be issued an entity must meet the training and management requirements under the Act). The process for the issuance of a tax incentive certificate is outlined in the diagram below:

- An Australian company (usually the operator of an Australian registered eligible vessel) applies for the issuance of a notice for a vessel under the Shipping Reform (Tax Incentives) Act 2012. A notice is only relevant for the first income year an Australian company wishes to apply for a certificate and is applied for an income year, at least three months before that income year ends. The company would apply for a notice under the Shipping Reform (Tax Incentives) Act 2012 if:

- it wanted its certificate (and therefore its tax incentive) to cover a period that extends earlier than the last three months of the first income year

- it wanted assurance, prior to the end of the income year, that it has met the eligibility requirements for a certificate to be issued under the Shipping Reform (Tax Incentives) Act 2012.

- A certificate is necessary to obtain the first three tax incentives listed above. The certificate is applied for after the end of the income year, but at least 30 days before the entity is required to lodge its income tax return for the income year. The first certificate that is issued to a company will only apply for the last three months of the first income year (unless the company has applied for and received a notice under the Shipping Reform (Tax Incentives) Act 2012 for the eligible vessel).

- Subsequent certificates are issued, upon application, after the end of each income year.

- Certificates are issued per applicant, per vessel, per income year.

Once a certificate is issued, the relevant tax incentives can be claimed via a company tax return submitted to the Australian Tax Office (ATO). Additional criteria for each of the tax incentives are contained in the Income Tax Assessment Act 1997 and the Income Tax Assessment Act 1936 (as amended by the Tax Laws Amendment (Shipping Reform) Act 2012), which are administered by the ATO.

It should be noted that regardless of the activities in which a vessel is engaged in, excluded vessels cannot qualify for a notice or a certificate (see subsection 10(4) of the Shipping Reform (Tax Incentives) Act 2012). Tugboats and offshore industry vessels are two examples of vessels that are excluded under the Shipping Reform (Tax Incentives) Act 2012.

Contact details for information on tax incentives

Director

Regulation and Programs Section

Maritime and Shipping Branch

Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts

GPO BOX 594, Canberra, ACT, 2601

Email: taxincentives@infrastructure.gov.au